Global Patriots Adjusters — professional public insurance adjusters — serves business owners, condo owners, and homeowners with major property damage insurance claims for major winter storms, ice dams, and pipe bursts in New Hampshire, Vermont, and Western Massachusetts, and the rest of New England (MA, RI, CT, and ME).

Global Patriot Adjusters wants to be there for you, to help you and make sure that you feel confident that you are getting all of the help you need throughout the entire claims process. We want to be there to fight for you and maximize your claim.

A bigger settlement amount for you:

Global Patriot Adjusters has a great track history of getting our clients — the insured — a much better claim payout amount than they can on their own. Below are a few examples for typical claims we handle for homeowners and business owners. The 5 insurance settlement examples below gave the insured policyholder an average INCREASE IN SETTLEMENT OF 418% and AN AVERAGE INCREASE OF $21,406!

Original claim amount from company: $900 — structural damage

Amount we arranged on behalf of insured: $12,000

Percent increased for the client: 1,233% ($11,100)

Original claim amount from company: $15,492.41 — wind damage

Amount we arranged on behalf of insured: $81,507.59

Percent increased for the client: 426% ($66,015), Worcester, MA

Original claim amount from company: $2,804.13 — water damage

Amount we arranged on behalf of insured: $10,270.18

Percent increased for the client: 266% ($7,466), Gardner, MA

Original claim amount from company: $15,893.83 — water damage

Amount we arranged on behalf of insured: $29,343.83

Percent increased for the client: 84% ($13,450), Portsmouth, NH

Original claim amount from company: $10,727.19 — freeze

Amount we arranged on behalf of insured: $19,727.19

Percent increased for the client: 84% ($9,000), Williamsburg, MA

At Public Insurance Adjusters, we specialize in providing comprehensive fire damage insurance claims help, offering the expertise of our experienced insurance adjusters. Dealing with the aftermath of a fire can be overwhelming, both emotionally and financially. That's where we step in. Our team of professionals is here to guide you through the insurance claim process, ensuring you receive the maximum amount of compensation you are entitled to. From documenting the extent of the damage to negotiating with the insurance company, we are dedicated to fighting for your rights and helping you rebuild your life. With our in-depth knowledge of insurance policies and regulations, we strive to make the claims process as smooth and stress-free as possible, allowing you to focus on rebuilding and recovering. Trust us to be your advocates in the fight for fair and just compensation.

While we cannot guarantee you will always get 4-5 times the amount you are first offered, we pride ourselves in always getting the maximum amount you need and deserve based on your particular loss and insurance policy. Contact Marc Lancaric for a free estimate.

PUBLIC INSURANCE ADJUSTERS

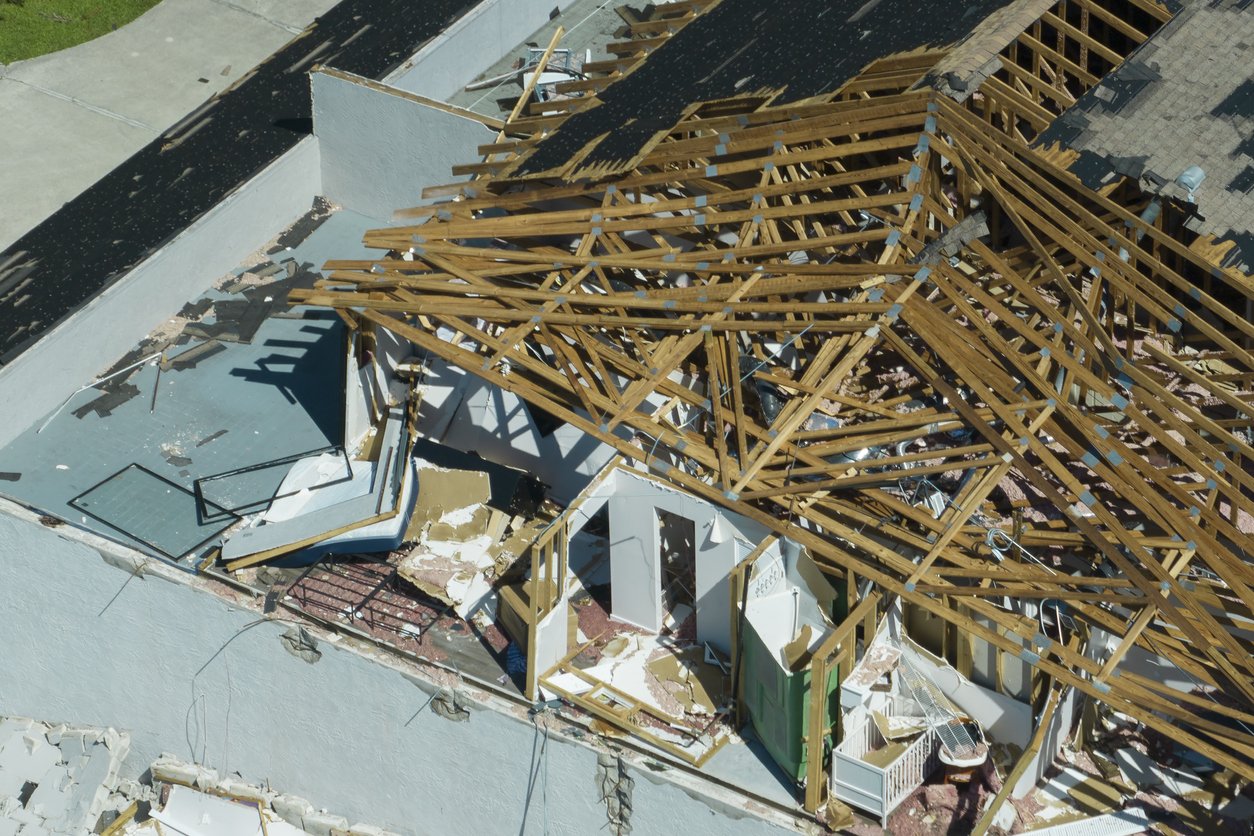

Wind, Flood, Fire, Structural Damage Claim Experts

How Can a Public Insurance Adjuster Help with My Fire Damage Insurance Claims?

Are you dealing with the aftermath of a fire at your property? We understand the stress, uncertainty, and emotional toll that a fire disaster can have on your life. But worry not, because Public Insurance Adjusters is here to help you navigate the complex world of fire damage insurance claims.

Dealing with your insurance company after a fire can be overwhelming, especially when you're still trying to recover from the traumatic event. That's where a public insurance adjuster comes in. Our expert team of fire damage claim specialists will advocate on your behalf to ensure you receive the maximum compensation you deserve.

But what exactly can a public insurance adjuster do for you in the aftermath of a fire disaster? Here are just a few ways we can provide invaluable assistance:

1. Expert Evaluation: Our adjusters have extensive experience in assessing fire damage and its impact on your property. We meticulously examine every aspect, from structural damage to personal belongings, to accurately determine the value of your claim. Our goal is to leave no stone unturned to ensure you receive a fair settlement.

2. Thorough Documentation: We understand that proper documentation is crucial when filing an insurance claim. Our team will professionally document the damage, including photographs, videos, and detailed reports. This comprehensive evidence will strengthen your position when negotiating with your insurance company.

3. Insurance Policy Expertise: Insurance policies can be complex, filled with confusing jargon and loopholes. Our public insurance adjusters are well-versed in policy language and have an in-depth understanding of the intricacies of fire damage claims. We will review your policy to identify all available coverage options and applicable policy endorsements to maximize your claim.

4. Negotiation with Insurance Companies: Our adjusters have extensive experience in negotiating with insurance companies. We will stand by your side, advocating fiercely to ensure that your best interests are protected throughout the claims process. With expert guidance and support, you can be confident that you are not being taken advantage of by your insurance provider.

5. Expedited Recovery: Dealing with a fire disaster can be physically and emotionally exhausting. By hiring a public insurance adjuster, you can focus on rebuilding your life, knowing that the complex insurance claim process is being handled by professionals. Our goal is to alleviate your stress and expedite the recovery