We are helping Lantana, FL homeowners, condominium associations, business owners, and property managers with Hurricane, Wind, Roof, and Mold damage insurance claims.

Minnesota St

W Palm St

Garnette St

Julie Hights Dr

W Ocean Ave

W Mango St

Lyndon Dr

W Bloxham St

S Broad St

La Costa Way

W Branch St

Other areas not listed, please call us at 561-408-5533.

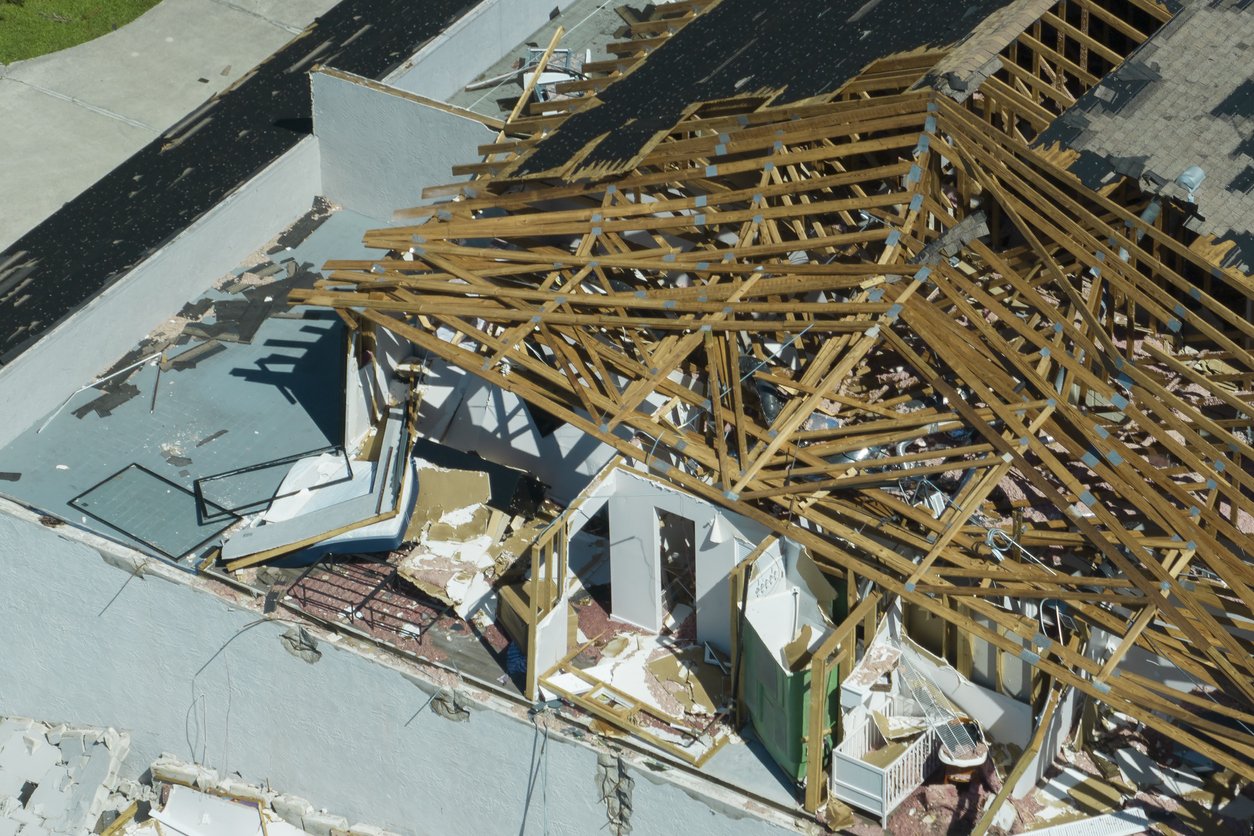

Recent Lantana, FL major Wind damage insurance claim

We can help insurance policyholders with their roof damage claims. We get you maximum payout and take the pain out of the claims process.

Global Patriot Adjusters is a company built on the single goal of bringing every dollar deserved to clients from an insurance claim. We maintain the best reputation in the Public Insurance Adjuster business because we take every claim for every client as a project with personal ownership and accountability. In cases where hurricanes and tropical storms appear out of nowhere and a bad accident happens, someone needs to be in your corner fighting for YOU!

Recent Lantana, FL major Fire damage insurance claim

Professional insurance public adjusters helping homeowners.

We specialize in wind and hurricane damage, water damage / pipe bursts, structural damage, mold and asbestos damage, business interruption, and more. Please contact us with any inquiries about our services at 561-408-5533 or contact us now.

Please contact us immediately for a Free Claims Evaluation for hurricane and wind damages. Call 561-408-5533 or fill out the form.

Lantana, FL major storm damage insurance claim

Providing Lanata, FL area residents and businesses with wind damage insurance claims help.

“My team is here to help you get the most money for your insurance claims. We work for you!” — Marc Lancaric

Global Patriot Adjusters, LLC

Marc Lancaric, Field Team Manager/ President

Florida Office: 701 S Olive Ave #1028, West Palm Beach, FL 33401 [Call for appointment 561-408-5533]

Maximizing Your Business Interruption Claim with a Public Insurance Adjuster in Lantana, FL

As a business owner in Lantana, FL, experiencing an interruption to your operations can be stressful and financially draining. Navigating the complexities of an insurance claim for business interruption can add to that stress. This is where a public insurance adjuster can be invaluable. Here are some tips to help you maximize your business interruption claim when working with a public insurance adjuster.

Understand the Role of a Public Insurance Adjuster

A public insurance adjuster is a licensed professional who works on behalf of policyholders, not insurance companies. They are skilled in evaluating, documenting, and negotiating claims to ensure you receive the maximum settlement. Hiring a public adjuster means you have an advocate who understands the intricacies of business interruption claims and can help you navigate the process more effectively.

Document Everything

From the moment your business is interrupted, start documenting everything. This includes taking detailed notes, photos, and videos of the damage and disruption. Keep records of all communications with your insurance company, as well as any expenses incurred due to the interruption. This documentation will be crucial in supporting your claim and providing your public adjuster with the necessary information to build a strong case.

Review Your Policy Thoroughly

Before filing a claim, thoroughly review your insurance policy. Understand the specific coverage terms, limits, and exclusions related to business interruption. Your public adjuster can help interpret complex policy language and ensure you are aware of all potential coverages. Knowing your policy inside and out will prevent misunderstandings and help you set realistic expectations for your claim.

Act Quickly but Carefully

Time is of the essence when filing a business interruption claim. Most policies have a time limit for reporting a claim, so it's important to act quickly. However, avoid rushing the process. Your public adjuster will guide you through the necessary steps to ensure all documentation is accurate and complete before submission. This careful approach can prevent delays and disputes with your insurer.

Maintain Open Communication

Maintain open and regular communication with your public adjuster throughout the claims process. They will keep you updated on the progress of your claim and advise you on any additional information or actions needed. By staying informed and involved, you can address any issues promptly and avoid potential setbacks.

Trust the Expertise of Your Public Adjuster

Your public insurance adjuster has the experience and knowledge to handle the complexities of a business interruption claim. Trust their expertise and follow their recommendations. They will work diligently to ensure you receive a fair and comprehensive settlement that covers your losses and helps you get your business back on track.

Conclusion

Dealing with a business interruption in Lantana, FL can be challenging, but a public insurance adjuster can make the claims process more manageable and successful. By documenting everything, understanding your policy, acting promptly, and maintaining open communication, you can maximize your business interruption claim and focus on restoring your operations.

Essential Hurricane Restoration Services for Commercial Properties in Lantana, FL

As a commercial property owner in Lantana, FL, you understand the importance of preparedness, especially during hurricane season. The aftermath of a hurricane or severe storm can leave your property with extensive damage, from structural issues to water infiltration. Here’s a guide to essential services and trusted companies that can help restore your commercial property swiftly and efficiently.

Structural Damage Repair

Addressing structural damage promptly is crucial to ensure the safety and stability of your building. SERVPRO of Lake Worth is renowned for its comprehensive structural repair services. Their team of professionals specializes in evaluating and repairing structural damage caused by hurricanes, ensuring your property is restored to its original condition.

Tree Damage Removal

Fallen trees and branches can cause significant damage and impede access to your property. Lantana Tree Service offers efficient tree removal services, handling everything from debris clearance to the removal of uprooted trees. Their prompt response ensures your property is safe and ready for further restoration efforts.

Roof Damage Repair

Roof damage is a common issue after a hurricane, leading to potential water leaks and structural problems. Roofing by Curry provides emergency roof repair services, addressing issues such as missing shingles, leaks, and other damages. Their swift action helps protect your property from further deterioration.

Water Pump Out Services

Flooding is a typical consequence of hurricanes, making immediate water removal essential to prevent mold growth and additional damage. Flood Pros USA offers 24/7 water pump-out services. Their advanced equipment and skilled team ensure rapid water extraction and thorough drying of affected areas, safeguarding your property from prolonged water damage.

Hurricane Restoration Services

For a comprehensive restoration solution, Paul Davis Restoration of Palm Beach County offers a wide array of services, including debris removal, mold remediation, and complete property restoration. Their experienced professionals work tirelessly to restore your commercial property to its pre-storm condition, minimizing downtime and financial loss.

Additional Tips for Hurricane Preparedness and Recovery

Insurance Check: Ensure your insurance coverage is up-to-date and understand the claims process for hurricane damage.

Emergency Kit: Maintain an emergency kit with essential supplies and contact information for local restoration services.

Regular Maintenance: Conduct regular inspections and maintenance of your property to fortify it against potential hurricane damage.

By partnering with these trusted companies, you can ensure a swift and effective recovery for your commercial property in Lantana, FL. Being prepared and knowing who to call in the event of a hurricane can make all the difference in protecting your investment and ensuring business continuity.

About Lantana, Florida

Lantana, FL, is a vibrant town located in Palm Beach County that offers a diverse range of neighborhoods, thriving businesses, and esteemed colleges in its vicinity. The neighborhoods in Lantana embody a sense of community, with well-maintained streets and charming homes. Whether you're seeking a waterfront property or a family-friendly suburban atmosphere, Lantana has options to suit any lifestyle. Additionally, the town is home to a bustling business district, with a variety of small shops, restaurants, and service providers. These local businesses contribute to the town's economic vitality and cater to the needs and preferences of its residents. For those seeking higher education, there are several esteemed colleges in close proximity to Lantana, including Palm Beach State College and Lynn University. These institutions provide opportunities for academic growth and contribute to the cultural diversity of the Lantana community. Overall, Lantana FL proves to be a dynamic and inviting place to live, work, and pursue higher education.

Important resources for residents, homeowners, and businesses in Lantana FL

Residents, homeowners, and businesses in or near Lantana, FL are fortunate to have access to a variety of important resources that cater to their needs. The Lantana Public Library stands out as a valuable asset offering a wide range of books, ebooks, and digital resources, providing both education and entertainment. The Lantana Chamber of Commerce serves as a valuable resource for local businesses, offering networking opportunities, business education, and support for community projects. Another important resource is the Lantana Recreation Center, which provides a plethora of recreational activities and facilities for residents of all ages. Furthermore, the Town of Lantana's official website serves as a comprehensive source of information on local government services, community events, and emergency preparedness. Collectively, these resources play a vital role in enhancing the quality of life for residents, homeowners, and businesses in the Lantana, FL area.

The Importance of Contacting a Public Insurance Adjuster for Lantana Florida Homeowners and Business Owners

Protecting Your Interests and Maximizing Your Claim

When it comes to major insurance claims resulting from hurricane or wind damage, Lantana FL homeowners and business owners find themselves facing numerous challenges and uncertainties. Naturally, their first instinct is to contact their insurance company and initiate the claims process. However, it is essential to recognize the potential advantages of reaching out to a public insurance adjuster before taking any further steps.

1. Superior Expertise and Experience:

Public insurance adjusters possess extensive knowledge and experience in handling insurance claims related to hurricane and wind damage. They specialize in evaluating, documenting, and negotiating claims on behalf of policyholders. Their expertise allows them to assess the true extent of the damage, ensuring that no details are overlooked or undervalued. By partnering with a public adjuster, homeowners and business owners can benefit from their extensive knowledge of insurance policies, ensuring they receive the maximum compensation they are entitled to.

2. Efficient and Timely Claims Process:

Navigating the insurance claims process can be overwhelming, particularly when dealing with critical issues such as hurricane or wind damage. Public insurance adjusters are well-versed in the intricacies of the claims process, from filing the initial claim to negotiating with the insurance company. By engaging a public adjuster right from the start, Lantana homeowners and business owners can streamline the process and avoid unnecessary delays or potential pitfalls. A public adjuster will guide them through the entire process, ensuring adherence to strict deadlines and requirements.

3. Fair Assessment and Adequate Compensation:

Insurance companies often attempt to settle claims for the least amount possible, prioritizing their own interests over those of their policyholders. By contacting a public insurance adjuster, Lantana homeowners and business owners can level the playing field. An experienced public adjuster will conduct a thorough evaluation of the damage, ensuring no losses are overlooked. They will then negotiate with the insurance company on behalf of the policyholder, advocating for fair compensation that accurately reflects the scope of the damage and the financial losses incurred.

4. Minimizing Stress and Burden:

Dealing with the aftermath of hurricane or wind damage can be an overwhelming and emotionally taxing experience. Sorting through insurance paperwork, documenting damages, and negotiating with the insurance company can add to the already significant stress homeowners and business owners face. By enlisting the services of a public insurance adjuster,