Summerland Key & Cudjoe Key FL Private Insurance Adjusters

We are helping Summerland Key & Cudjoe Key FL residents and business owners with hurricane wind, flood, and mold damage insurance claims in these areas:

Cudjoe Key

Town Center including: Ramrod Key and Big Torch Key

Sugarloaf Shores / Perky

Other areas not listed. Please call us us at 561-408-5533.

Global Patriot Adjusters is a company built on the single goal of bringing every dollar deserved to clients from an insurance claim. We maintain the best reputation in the Public Insurance Adjuster business because we take every claim for every client as a project with personal ownership and accountability. In cases where hurricanes, like Hurricane Irma, and storms appear out of nowhere and a bad accident happens, someone needs to be in your corner fighting for YOU!

We specialize in wind and hurricane damage, and more. Please contact us with any inquiries about our services at 561-408-5533 or contact us now.

Please contact us immediately for a Free Claims Evaluation for Hurricane Irma wind damages. Call 561-408-5533 or fill out the form.

“My team is here to help you get the most money for your insurance claims. We work for you!” — Marc Lancaric

Global Patriot Adjusters, LLC

Marc Lancaric, Field Team Manager/ President

Maximizing Your Roof Damage Claim with a Public Insurance Adjuster in Summerland Key, FL

Roof damage can be a significant concern for homeowners in Summerland Key, FL. Hurricanes, tropical storms, and other severe weather conditions can compromise the integrity of your roof, leading to costly repairs. Filing an insurance claim for roof damage can be complex and stressful. Hiring a public insurance adjuster can help ensure you receive the full compensation you deserve. Here’s how a public adjuster can assist you and tips to maximize your roof damage claim.

Benefits of Hiring a Public Insurance Adjuster

Expert Knowledge: Public adjusters are licensed professionals specializing in managing insurance claims. They have in-depth knowledge of policy details and can identify all available coverages, ensuring no potential claims are overlooked.

Detailed Documentation: Public adjusters meticulously document all roof damage, capturing every detail. This comprehensive documentation strengthens your claim and prevents undervaluation by the insurance company.

Skilled Negotiation: Public adjusters negotiate directly with your insurance company on your behalf, advocating for a fair settlement. Their experience often results in higher compensation compared to handling the claim alone.

Tips for Homeowners

Immediate Action: Contact a public insurance adjuster as soon as you notice roof damage. Early involvement allows the adjuster to gather timely evidence and prevent further issues. Delaying this step can result in additional damage and complicate the claims process.

Maintain Records: Keep detailed records of all communications with your insurance company. Take photos and videos of the roof damage from multiple angles, and save any relevant documents, such as repair estimates, invoices, and previous maintenance records.

Comprehensive Assessment: Work with your adjuster to perform a thorough assessment of the roof damage. Ensure both visible and hidden damages are accounted for, as some issues may not be immediately apparent.

Understand Your Policy: Make sure you understand the terms and conditions of your insurance policy. Your public adjuster can help interpret these terms and guide you on the necessary steps to avoid jeopardizing your claim. Be aware of any deadlines for filing claims and submitting documentation.

Choose a Reputable Adjuster: Select a reputable public adjuster by checking credentials, reviews, and references. A trustworthy professional ensures a smoother claims process and better outcomes.

By hiring a public insurance adjuster in Summerland Key, FL, you can alleviate the stress of filing a roof damage claim and improve your chances of receiving fair compensation. Their expertise, detailed documentation, and negotiation skills are invaluable in helping you restore your home. Don’t let the complexities of the claims process overwhelm you—get the professional support you need to navigate it effectively.

Maximizing Your Business Interruption Claim with a Public Insurance Adjuster in Cudjoe Key, FL

Business interruptions can pose significant challenges for business owners in Cudjoe Key, FL. Whether due to hurricanes, severe weather, or other unforeseen events, these interruptions can impact your operations and revenue. Filing an insurance claim for business interruption is often complex and time-consuming. Hiring a public insurance adjuster can help ensure you receive the full compensation you deserve. Here’s how a public adjuster can assist you and tips to maximize your business interruption claim.

Benefits of Hiring a Public Insurance Adjuster

Expert Knowledge: Public adjusters are licensed professionals who specialize in managing insurance claims. They understand the nuances of policy language and can identify all available coverages, ensuring you get the compensation you are entitled to.

Detailed Documentation: Public adjusters meticulously document the extent of your business interruption, including lost income, extra expenses, and other related financial impacts. This comprehensive documentation strengthens your claim and prevents undervaluation by the insurance company.

Skilled Negotiation: Public adjusters negotiate directly with your insurance company on your behalf, advocating for a fair settlement. Their experience often results in higher compensation compared to handling the claim alone.

Tips for Business Owners

Immediate Action: Contact a public insurance adjuster as soon as you experience a business interruption. Early involvement allows the adjuster to gather timely evidence and prevent further issues. Delaying this step can complicate the claims process and potentially reduce your compensation.

Maintain Detailed Records: Keep meticulous records of all communications with your insurance company. Document the extent of the business interruption with photos, videos, and any relevant documents, such as financial statements, contracts, and invoices. This evidence is crucial for substantiating your claim.

Comprehensive Assessment: Work with your adjuster to perform a thorough assessment of the business interruption. Ensure that all financial impacts, both direct and indirect, are accounted for. This includes lost income, additional expenses incurred to maintain operations, and potential costs of temporary relocation.

Understand Your Policy: Make sure you understand the terms and conditions of your insurance policy. Your public adjuster can help interpret these terms and guide you on the necessary steps to avoid jeopardizing your claim. Be aware of any deadlines for filing claims and submitting documentation.

Seek Professional Advice: Consult with accountants, financial advisors, and other professionals who can provide additional insights and support during the claims process. Coordinating with your public adjuster and other experts ensures a comprehensive approach to your claim.

Choose a Reputable Adjuster: Select a reputable public adjuster by checking credentials, reviews, and references. A trustworthy professional ensures a smoother claims process and better outcomes.

Conclusion

Business interruptions can be devastating, but having a public insurance adjuster on your side can significantly ease the burden. In Cudjoe Key, FL, a public adjuster can help you navigate the complexities of your insurance policy, accurately document your losses, and negotiate effectively with your insurer. By following these tips and leveraging the expertise of a public insurance adjuster, you can maximize your business interruption claim and focus on getting your business back on track. Don’t let the claims process overwhelm you—get the professional support you need to secure the compensation you deserve.

Hurricane Remediation Services for Business Owners in Summerland Key, FL

Operating a business in Summerland Key, FL, offers the charm and beauty of coastal living but also comes with the challenges of hurricanes and severe storms. These natural disasters can cause significant damage to your property, disrupt operations, and pose serious safety hazards. Knowing which local services to contact for quick and professional help is crucial for a swift recovery. Here’s a guide to essential hurricane remediation services available for business owners in Summerland Key.

Tree Damage Services

Storms can bring down trees, causing damage to buildings, vehicles, and power lines. Prompt removal and cleanup are essential to ensure safety and restore normalcy.

1. Summerland Key Tree Services: Specializing in storm-related tree damage, Summerland Key Tree Services offers efficient tree removal and cleanup. Their experienced team works quickly to clear your property and mitigate further risks.

2. Coastal Arbor Care: Offering emergency services, Coastal Arbor Care focuses on safely removing fallen trees and debris, securing your property and minimizing disruption to your business operations.

Roof Damage Repair

Roof damage is a common issue following hurricanes, requiring immediate attention to prevent further water damage and structural issues.

1. Summerland Key Roofing Solutions: This company provides expert roof repair services, swiftly addressing storm damage to protect your business from additional weather-related problems. They handle everything from minor repairs to full roof replacements.

2. Hurricane Roofing Pros: Specializing in hurricane damage, Hurricane Roofing Pros deliver high-quality roof repair and replacement services. They use durable materials designed to withstand future storms, ensuring long-term protection for your building.

Mold Damage Restoration

Water damage from storms can lead to mold growth, posing health risks and structural damage. Professional mold remediation is crucial to ensure a safe and healthy environment.

1. Rapid Response Mold Remediation: Offering comprehensive mold damage restoration services, Rapid Response uses advanced techniques to remove mold and prevent its recurrence. Their quick action helps restore your business to a safe condition.

2. AquaClean Mold Services: Known for thorough and efficient mold removal, AquaClean ensures your business is free from mold hazards. Their experienced technicians work diligently to restore your property to its pre-storm condition.

General Hurricane Remediation Services

Comprehensive hurricane remediation services cover a range of needs from debris removal to complete structural repairs, ensuring your business can be restored to its former state.

1. Summerland Key Restoration: This company provides full-service hurricane restoration, including debris cleanup, structural repairs, and water damage restoration. Their experienced team ensures your property is thoroughly cleaned and repaired, making it safe for you, your employees, and customers.

2. SERVPRO of Summerland Key: A trusted name in disaster recovery, SERVPRO offers extensive storm damage restoration services. They handle everything from water extraction to complete property restoration, helping you recover quickly and efficiently.

Preparing for Future Storms

While it’s crucial to know which services to contact after a storm, taking proactive measures can help minimize damage and ensure a quicker recovery:

Develop an Emergency Plan: Ensure that you have a comprehensive emergency plan in place. This should include evacuation procedures, communication strategies, and a list of essential contacts. Make sure all staff members are familiar with this plan.

Regular Maintenance: Conduct regular maintenance of your property to minimize potential damage during a storm. This includes trimming trees, inspecting the roof, and ensuring proper drainage systems.

Insurance Review: Regularly review your insurance policies to ensure adequate coverage for hurricane-related damages. This will help you recover costs associated with repairs and replacements.

Secure Important Documents: Keep vital business documents, including insurance policies and financial records, in a safe, waterproof container. This will help expedite the recovery process.

Conclusion

Recovering from hurricane and storm damage requires immediate and professional attention. By partnering with trusted local companies specializing in tree damage, roof repair, mold restoration, and general remediation, business owners in Summerland Key, FL, can ensure their properties are restored swiftly and safely. Keep these contacts handy to protect your business from the unpredictable forces of nature. Stay prepared and know that help is available when you need it most. Taking proactive measures and knowing which services to rely on can minimize the impact of future storms and maintain the safety and functionality of your business.

About Summerland Key & Cudjoe Key, Florida (including: Ramrod Key and Big Torch Key)

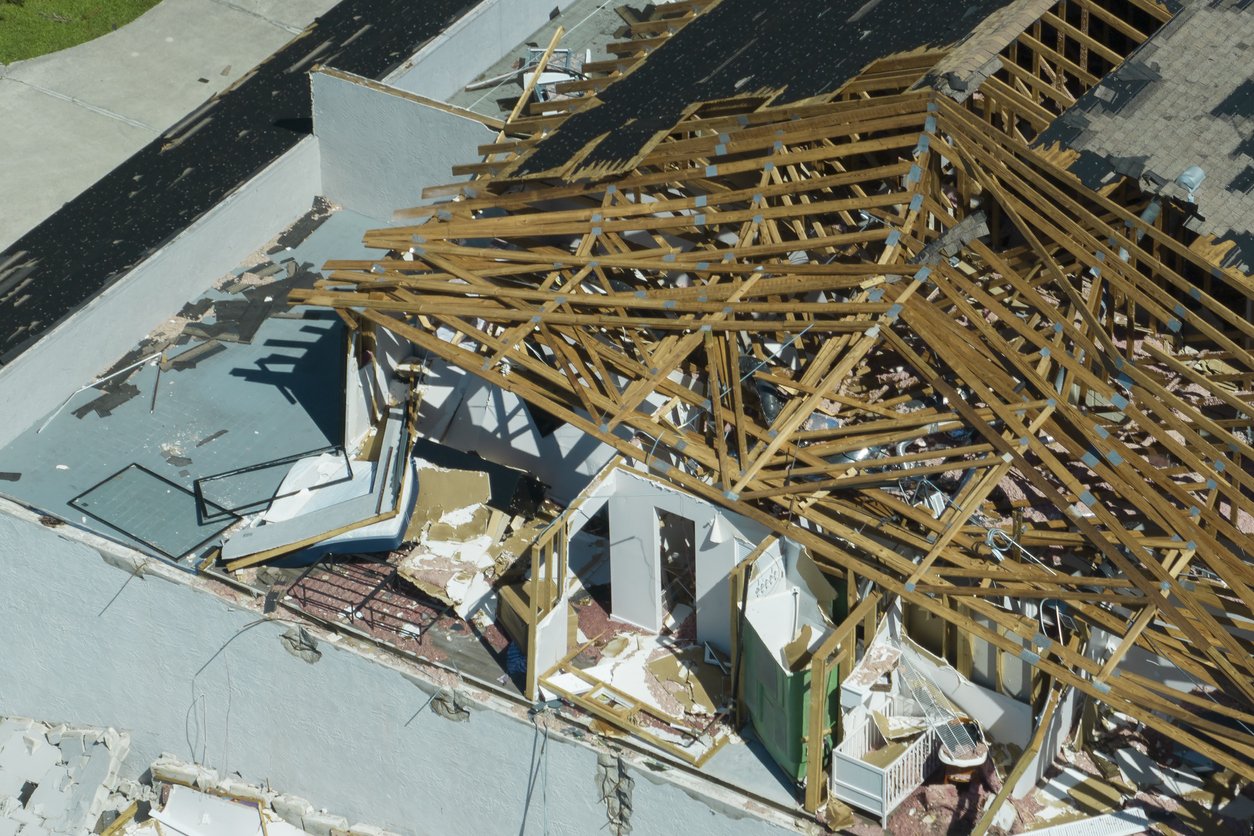

Hurricane Irma damage in Ramrod Key, Florida.

Summerland Key, FL (including Cudjoe Key, FL, Ramrod Key, FL, Big Torch Key, FL) is a somewhat small town located in the state of Florida. With a population of 6,743 people and three constituent neighborhoods, Summerland Key, FL is the 247th largest community in Florida.

Another notable thing is Summerland Key, Florida (including Cudjoe Key, FL, Ramrod Key, FL, & Big Torch Key, FL) is an extremely popular vacation destination. A significant portion of the population is seasonal. During the vacation season, the town experiences a large influx of people who take up residence in second homes they own in the area. As the vacation season ends, the population drops again, leaving behind a substantially quieter and smaller town.